Cloud computing has brought significant benefits, but it also has one downside: unpredictable costs. Unlike on-premises infrastructure, where you’ve got fixed expenses tied to hardware and maintenance, cloud spending fluctuates dynamically based on usage, pricing tiers, discount mechanisms and more. No set bills, no predictability—just a meter running that can spiral out of control if you’re not watching it. To tackle this mess, you need a structured approach. This is where FinOps comes in. FinOps is a practice built to squeeze maximum business value out of your cloud investments. The FinOps Foundation has mapped out a comprehensive framework that includes key components like FinOps principles, FinOps personas, FinOps domains and capabilities, FinOps Lifecycle (Inform, Optimize, Operate)—and a FinOps maturity model. Among these components, FinOps principles are the basic building blocks for establishing an effective cloud cost management practice and driving continuous improvement.

In this article, we will cover the basics of FinOps and its framework, along with its components. Then, we will deep dive into the core focus of this article: the six fundamental FinOps principles that are essential for achieving effective cloud cost optimization. Let's explore these FinOps principles in detail.

What is FinOps?

To truly understand the FinOps principles, you first need to know what FinOps is. As we covered in detail in a previous article, FinOps is a crucial discipline for modern cloud environments. For a quick refresher, here's the definition provided by the FinOps Foundation:

FinOps is an operational framework and cultural practice which maximizes the business value of cloud, enables timely data-driven decision making, and creates financial accountability through collaboration between engineering, finance, and business teams.

Check out this video to get an overall idea of what FinOps really is:

FinOps 101: What is FinOps? - FinOps Foundation - FinOps principles

Why FinOps?

FinOps provides a structured approach to managing cloud costs and aligning them with your business objectives. With FinOps, you get:

1) Optimized Cloud Spending — FinOps identifies and eliminates waste, ensuring efficient use of cloud resources and reducing unnecessary costs.

2) Better Decision-Making — FinOps provides comprehensive visibility into cloud consumption and associated costs, so you can make quick, informed decisions that align with your goals.

3) Stronger Financial Performance — FinOps brings people from IT, finance, and business together, creating a culture where everyone works together to manage cloud spending.

4) Improved Cost Visibility and Transparency — FinOps provides real-time reporting/insights into cloud usage and costs, improving transparency and clarity across teams.

5) Team Accountability — FinOps promotes shared responsibility among engineering, finance, and business units, integrating cost management into daily operations.

6) Strengthened Governance and Control Mechanisms — FinOps involves establishing clear policies, processes, and best practices for managing cloud spending.

7) Improved Cloud ROI — FinOps maximizes the return on cloud investments by linking spending to measurable business value.

… and more!!

When to Initiate FinOps Practices?

Deciding when to kick off FinOps has shifted over time. A few years ago, companies often waited for a “spend panic”—a moment when cloud bills soared past budgets—before acting. That’s completely changed. Today, many organizations start FinOps right at the beginning of their cloud adoption. The big cloud providers themselves—AWS, Azure, and Google Cloud—are playing a big role in this shift. They've been expanding their cost tools and data, and that's giving organizations/companies a better insight on their cloud spend from the very start. As a result, organizations are now factoring costs into their cloud solutions from day one.

Don't get it twisted: FinOps isn't only about cutting costs. Sure, if you're spending millions on cloud services, you'll see savings quickly. But it's bigger than that. FinOps increases team accountability and allows you to fully allocate costs, which is important regardless of the size of your budget. Waiting till costs escalate misses the point. The true benefit comes from implementing this strategy early on, especially since changing your team's culture and skills—think engineers understanding finance and finance professionals decoding clouds—takes time. Larger organizations with sophisticated setups experience even larger benefits from starting sooner.

You don’t need a massive cloud footprint to justify FinOps. Start very small, even with a minimal setup, then scale up as your cloud usage increases. The FinOps Foundation supports this approach: start with basic visibility and mature the practice as your business demands. Remember this: it is not a plug-and-play system; you cannot set up a full-fledged FinOps operation overnight. It is a steady shift. Engineers must reconsider how they develop, financial teams must adjust to the complexities of the cloud, and executives must understand why it all matters. That muscle of data-driven accountability? It builds over months, not minutes.

In the past, companies jumped into FinOps one of two ways. Some waited for a crisis—an executive slamming the brakes on cloud development following a budget blowout. That is reactive, chaotic, and slows innovation as you scramble. Smarter teams take an active strategy that aligns with the FinOps maturity model. They start with one person handling provider commitments, setting up basic tagging and account structures, then scale as needed. Most newcomers to the FinOps Foundation now take this path.

No matter when you start off, the first step is straightforward: provide your teams with real-time visibility into their cloud spending. That is the foundation—knowing what is going on so you can take action before the costs escalate. As your FinOps practice matures, you'll be able to prevent overruns by making wise architectural choices. Meanwhile, educate everyone—finance learns cloud terminology, engineers understand cost principles and business leaders make better resource allocation decisions. Start early and you'll see results quickly, including tighter control and smarter decisions. Delaying it only sets you up for a greater mess later.

What is the FinOps Framework?

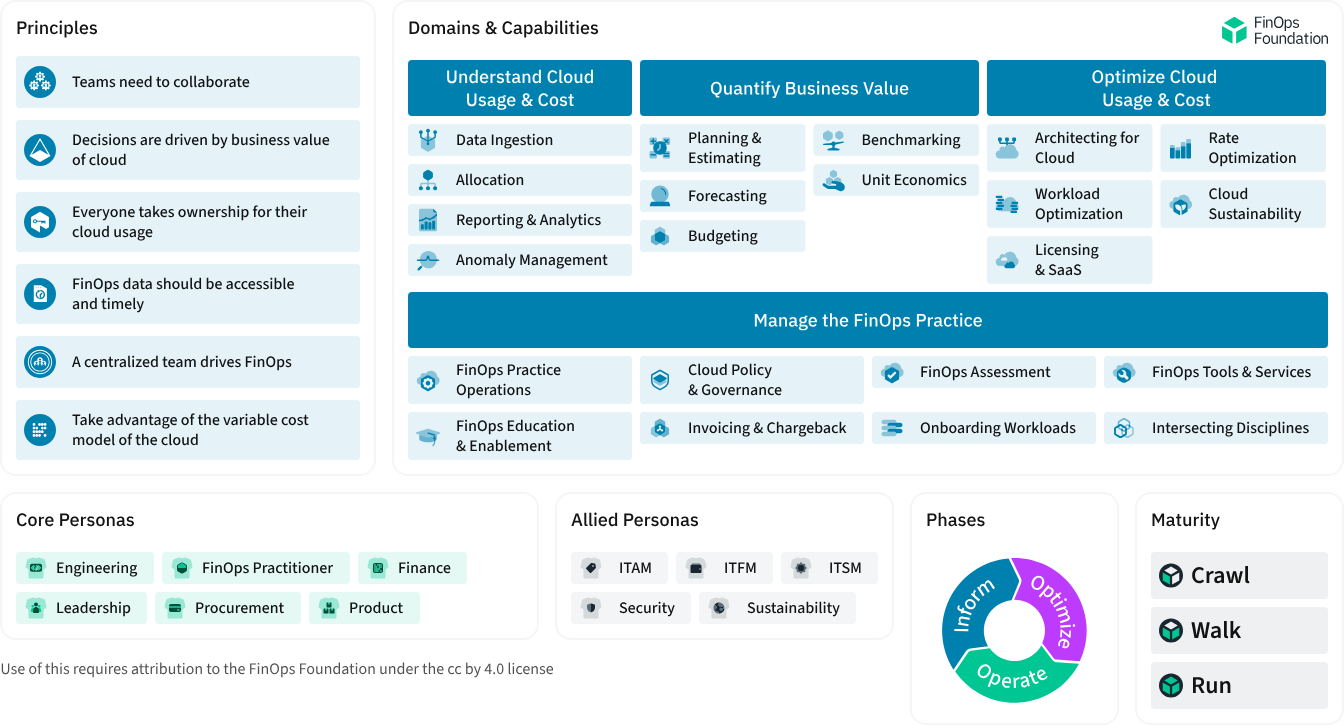

The FinOps Foundation has developed a comprehensive framework that outlines how FinOps practices can be effectively implemented within an organization. The FinOps framework consists of several key components that are essential for successful cloud cost monitoring, management, and optimization.

🔮 FinOps Principles

These are the guiding rules for managing cloud spending. They lay out best practices for data-driven decision-making and accountability. The six core FinOps Principles are:

- Team Collaboration

- Business Value–Driven Decisions

- Ownership & Accountability

- Accessible, Timely Reporting

- Centralized FinOps Team

- Leveraging the Variable Cost Model of the Cloud

This article focuses specifically on these FinOps principles. You'll find a more detailed explanation in the following section.

🔮 FinOps Personas

These represent the various roles within an organization—such as engineers, finance professionals, product owners, and operations staff—that play a crucial part in a successful FinOps practice. Each persona has specific responsibilities that, together, keep your cloud spending in check.

🔮 FinOps Domains & FinOps Capabilities

FinOps Framework categorizes cloud financial management into four primary domains. Each FinOps domain groups a set of related FinOps capabilities that help an organization manage and optimize cloud spending while tracking the business impact of its cloud investments.

🔮 FinOps Lifecycle Phases

FinOps framework is organized into phases that reflect how you handle cloud costs over time. Typically, these phases include the initial stage of gaining visibility (Inform), the process of adjusting resources (Optimize), and the ongoing integration of cost data into operations (Operate).

🔮 FinOps Maturity Model

The FinOps Maturity Model provides a framework for organizations to assess and understand their current level of FinOps maturity and to identify areas for growth. It typically outlines stages like Crawl, Walk, and Run, illustrating how organizations can start with basic FinOps practices and progressively develop more advanced and integrated approaches as their cloud usage and organizational needs evolve.

Collectively, these components form the FinOps framework—a dynamic and adaptable roadmap that helps you align cloud investments with business outcomes.

Now in this article, we focus on FinOps principles, which form the bedrock of effective cloud cost optimization. Let's dive into these principles in detail.

The 6 FinOps Principles

Each principle in the FinOps approach offers specific guidance on managing cloud costs effectively. Here is an overview of all 6 FinOps principles:

All 6 Core Principles of FinOps and Tips on How to Apply Them

FinOps principles are the basic building blocks to help you integrate cost management into your operational practices. They are designed to drive collaboration, accountability, and proactive resource management.

FinOps Principle 1—Teams Need to Collaborate

FinOps relies on collaboration. It breaks down traditional silos between finance, engineering, and business teams, who have rarely collaborated in the past. Effective collaboration fundamentally transforms cloud cost management. Finance begins speaking cloud, offering reports that match its speed and detail. Product managers adjust scaling predictions to include revenue from new features. Engineers? They begin evaluating cost as a primary efficiency parameter, alongside performance and uptime.

Your FinOps team plays a key role here, too. They're more than simply cheerleaders—they refine metrics everyone agrees on to measure efficiency. They establish governance rules and usage constraints that keep costs under control without choking innovation or slowing delivery. It's a balancing act: keep costs under control while allowing your teams to expand quickly and smartly. Think of it as laying down guardrails, not roadblocks.

The real secret to FinOps success is having a culture that doesn't play the blame game. Cost overruns happen; it’s cloud life. But instead of pointing fingers, you focus on learning. A deep post-incident review skips the blame game and digs into what went wrong—how do you dodge that hit next time? Maybe it’s better tagging, tighter forecasts, or more strategic architecture choices. Collaboration means everyone’s in the loop, fixing the system, not the scapegoat. That’s how FinOps turns a mess into progress.

Here's how to put it into practice:

- Schedule recurring meetings where finance, engineering, and product teams review real-time cost data and discuss optimization strategies.

- Pick cost management tools that provide a single source of truth everyone can access.

🔮 Pro Tip: Use collaboration tools like Slack, Discord, Teams, or any medium to keep everyone informed and on the same page, so you can make decisions quickly.

FinOps Principle 2—Decisions are Driven by the Business Value of Cloud

When you look at your cloud bill, it's natural to consider it as a massive expense to deal with. Don’t. FinOps flips that mindset—cloud isn’t just a cost sink, it’s a value engine. The more you lean into it, the higher the cost climbs, sure, but that’s not the point. Your job with FinOps is to max out the business value tied to every penny spent, not just slash the monthly total.

Rather than analyzing raw cost data in isolation, organizations must correlate cloud spending with specific business metrics—such as revenue per gigabyte of storage, transactions per compute hour, or cost per customer acquisition—to assess cost efficiency. Each workload should be examined through its return on investment (ROI); if a resource-intensive service drives significant revenue or accelerates time to market, its cost is justified. Otherwise, the architecture, resource allocation, or usage patterns should be reexamined for potential optimization.

Implementing this principle requires advanced cost attribution techniques. Automated resource tagging, API-integrated dashboards, and granular reporting systems provide a unified view of cloud spending tied directly to business outcomes. These tools let you analyze data in real-time, so you can make sure your cost-saving efforts are in line with your overall goals.

Here's how to put it into practice:

- Connect cloud cost management platforms with business intelligence systems to monitor expenses against clearly defined KPIs.

- Develop data-driven models that quantify cloud costs in terms of business impact, such as cost per transaction or cost per user—making sure that every dollar spent directly contributes to strategic goals.

- Establish regular review cycles to refine resource allocation based on real-time cost and performance data.

🔮 Pro Tip: Utilize FinOps tools to gain real-time insights into your spending. Track essential metrics like cost per service, usage trends, and deviations from your budget.

FinOps Principle 3—Everyone Takes Ownership & Accountability for Their Cloud Usage

Cloud costs tie straight to usage—it’s that simple. If you’re firing up instances or spinning up storage, you’re racking up the bill. FinOps principles lean hard into this: push accountability out to the edges, right down to the engineers and their teams. You’re using the cloud? You own the spend. Just a straight path from action to cost—no blame game here.

Here’s how it works. Give your teams the data and guidance they need to handle this. Real-time cost dashboards, tagging standards, budget alerts—stuff that lets them see the impact of their choices. Say an engineer launches a test environment and forgets to shut it down. Without ownership, that’s a quiet leak in your budget. With FinOps, they’ve got the tools to spot it and kill it fast. It’s not about babysitting; it’s about handing over the control with the right support.

Ever think about who’s really driving your cloud bill? It’s not just the finance folks—it’s everyone clicking “deploy”. Spreading ownership means your engineers start thinking about cost alongside code. They’re not just building features; they’re keeping the meter in check. It takes some getting used to, but once it works, you’ve got a team that’s as sharp on spending as they are on tech. That’s FinOps doing its thing.

Here's how to put it into practice:

- Give product and feature teams the power to keep an eye on and manage their own cloud usage and spending.

- Set up a granular tagging system so every expense can be easily traced back to where it came from.

- Set up budget thresholds and anomaly detection using native tools or third-party solutions to notify teams of spending spikes in real time.

FinOps Principle 4—FinOps Data Should Be Accessible and Timely

Literally, every second matters on the cloud. With compute billed down to microseconds, storage that’s always on, and services triggered by external events, waiting for a monthly cost report is a recipe for disaster. Instead, FinOps demands that cost data be continuously available and updated in real time, enabling teams to respond to spend changes immediately through automated alerts and integrated dashboards.

Data Where It Matters

Put the numbers where the action happens. Engineers and operations teams must have immediate access to granular cost data. Integrating cost insights directly into workflows—via API-driven dashboards, event-triggered alerts (via Slack, Discord or Teams), or automated notifications—guarantees that every resource change is reflected in near real time. Because of this continuous feedback loop, it allows teams to identify anomalies, such as an unintentionally active test environment, and take corrective action immediately.

Clean Data, Smart Moves

Speed is only half the game—your data needs to be rock-solid too. FinOps calls for fully loaded costs, not some crude estimate. Deduct those prepayments from commitment deals, plug in your real discounted rates, and split shared costs fairly across teams. Map everything to the configuration of your organization. Mess this up, and your crew’s making choices on garbage numbers. Bad data, bad moves—value goes out the window.

Cloud can be brutal—shared clusters, auto-deployments, and external triggers adding up fast. Those quarterly reports from back in the day just don't cut it anymore. You're gonna need real-time FinOps data to keep up. When teams have the right info at the right time, they can avoid overspending, optimize like pros, and actually drive some value. But if you skip off or delay, you'll be stuck playing catch-up instead of preventing the mess.

So, keep it accessible, keep it timely, and watch your cloud spend stay in line. Anything less, and you’re just guessing with your money.

Here's how to put it into practice:

- Set up event-driven pipelines to grab and process cost data from multiple cloud sources in almost real time.

- Make cost insights easily accessible within operational tools, so engineers and ops teams can see spending metrics right away when deploying and configuring.

- Create strict tagging rules to accurately track who's spending what.

🔮 Pro Tip: Use AI-powered analytics and automated alert systems to detect anomalies and notify teams immediately when spending deviates from expected patterns.

FinOps Principle 5—A Centralized Team Drives FinOps

You can’t shift a company’s culture without someone holding the flag. That’s where a centralized FinOps team comes in—your go-to crew for pushing FinOps principles across the org. They’re the ones teaching, standardizing, and preaching the gospel of smart cloud spending. They’re the experts tweaking tools for better data and reshaping processes so your org can actually do FinOps right.

Here’s the deal: this team takes the control on rate optimization—negotiating discounts and commitments with cloud providers—so your edge teams can focus on trimming usage. It’s a split that works. Centralize the “pay less” part, decentralize the “use less” part. Top companies nail this balance, and it shows in their bills.

Oh, and they bring benchmarking into the mix. Your FinOps team pulls data to show how you stack up—internally and out in the wild. Internal benchmarks pit teams against each other on optimization stats. External ones? They measure you against industry norms. It’s like a report card—spending too much? Too little? Could you shift gears? Hard numbers cut through the guesswork and keep everyone honest.

A central team isn’t just nice to have—it’s the engine. Without them, you’re stuck with scattered efforts and no cohesion.

Here's how to put it into practice:

- Create a dedicated FinOps team to set and enforce policies for managing cloud expenses.

- Set up tools and real-time dashboards that give you a clear picture of what's going on and send automated alerts when spending trends change.

- Take advantage of the team's scale to negotiate better deals and discounts with cloud providers.

- Compare your performance to industry standards to find ways to improve and keep getting better.

FinOps Principle 6—Take Advantage of the Variable Cost Model of the Cloud

Cloud is a whole different beast—no more blind guessing about what you’ll need six months out. FinOps flips this on its head, focusing on the here and now, and keeping things streamlined. The variable cost model means you’re not locked into big upfront buys. Instead, you can tweak capacity in real time, asking yourself, “How do we keep costs in check with what’s currently running?” You're using actual data—your usage stats—to guide smart decisions like rightsizing, scoring volume discounts, or grabbing Reserved Instances, Savings Plans, or Committed Use Discounts. If demand suddenly spikes, no worries—you can always scale up later.

The trick? Squeeze every drop from what you’ve got running. Use less, and use it smart—shut down idle resources, pick the right instance sizes, keep it lean. As your cloud game levels up, lean into native services that scale with demand. Think auto-scaling groups or serverless setups that flex without you lifting a finger. Spot instances? They’re gold when you need cheap compute for short bursts. Ever kick yourself for overbuying capacity that just sits there? This principle keeps your spend nimble, matching the cloud’s pay-as-you-go vibe. Stay sharp, and you’ll squeeze value out of every byte.

It’s real-time budgeting with a twist. You’re not stuck overbuying capacity to play it safe. Focus shifts to efficiency, tweaking as you go. That’s the cloud’s edge—FinOps just helps you ride it right.

Here's how to put it into practice:

- Implement auto-scaling groups and serverless setups to adjust capacity as needed.

- Switch to agile budgeting and forecasting models that incorporate real-time usage data.

- Use integrated cost management tools and cloud provider APIs to keep an eye on usage and trigger scaling events.

- Study workload patterns to decide when to commit to reserved capacity or use on-demand pricing or spot instances.

🔮 Pro Tip: Use services like AWS Auto Scaling, Azure VM Scale Sets, or Google Cloud Managed Instance Groups to automatically scale resources. You should also set up cost-management dashboards and alerts to optimize cloud spending in real-time based on live data.

References & Further Reading

- FinOps Foundation - What is FinOps?

- FinOps 101 article

- FinOps Framework Overview

- Benefits of FinOps - Infracost

- FinOps Principles

- Cloud FinOps book

- What is FinOps? The operating model and cultural practice for maximizing the value of cloud

- FinOps Explained in 5 Minutes | What is FinOps?

- What is FinOps and 3 reasons why you should care about it

Conclusion

And that’s a wrap! FinOps helps you manage cloud costs in a way that supports your business goals. Applying these six FinOps principles creates a framework that makes cloud spending a valuable resource, not a budget-buster. But adopting FinOps isn't just about tech - it's a cultural shift too. When everyone in the team knows how they're using cloud resources and is held accountable, cloud cost optimization becomes second nature. You start making decisions based on both tech and financial factors. So, when you implement these FinOps principles, step back and evaluate your processes. See where you can improve and what new techniques you can implement. Keep in mind that cloud technology evolves quickly, so your FinOps strategy must keep up.

In this article, we have covered:

- What is FinOps?

- When Should You Start FinOps?

- What is the FinOps Framework?

- The 6 FinOps Principles:

- FinOps Principle 1—Teams Need to Collaborate

- FinOps Principle 2—Decisions are Driven by the Business Value of Cloud

- FinOps Principle 3—Everyone Takes Ownership & Accountability for Their Cloud Usage

- FinOps Principle 4—FinOps Data Should Be Accessible and Timely

- FinOps Principle 5—A Centralized Team Drives FinOps

- FinOps Principle 6—Take Advantage of the Variable Cost Model of the Cloud

… and so much more!

FAQs

What is the meaning of FinOps?

FinOps is a framework that unites finance, engineering, and business teams to manage and optimize cloud spend. It shifts cost management from a static, monthly review to a real-time, data-driven practice that aligns cloud expenses with business outcomes.

What is the goal of FinOps?

The goal of FinOps is to maximize the value of your cloud investments. It does this by providing real-time visibility into cloud costs, enabling you to rightsize resources, and fostering a culture of accountability so that every dollar spent is directly tied to business performance.

What distinguishes FinOps from traditional cost management?

FinOps addresses the dynamic nature of cloud pricing. Traditional cost management often relies on fixed budgets and periodic reports, while FinOps offers real-time, granular insights. It integrates cost control directly into your development processes, promoting collaboration across teams to continuously adjust spending based on actual usage.

How do I begin a FinOps program in my organization?

Start by setting up tools for real-time cost visibility, adopt a consistent tagging strategy, and establish a centralized FinOps team. Begin with basic reporting and gradually introduce optimization measures.

Can FinOps help me improve resource utilization?

Yes. FinOps practices, such as right-sizing and auto-scaling, allow you to match resource allocation to actual usage, reducing waste and lowering costs.

Who should be involved in FinOps?

FinOps is a cross-functional effort. It involves engineering teams, finance departments, product managers, and a central FinOps team that coordinates efforts and sets best practices.

What is the first principle of FinOps?

The first principle is "Teams Need to Collaborate." It calls for breaking down silos between finance, engineering, and product teams so everyone can share cost data, adjust resource use together, and drive cloud cost efficiency.

What are some common pitfalls in implementing FinOps?

Common challenges include inconsistent tagging, resistance to cultural changes, data silos, and integration issues with legacy systems. Overcoming these requires standardization, clear communication, and centralized data collection.

Is a dedicated FinOps team necessary to begin implementation?

You can start FinOps with a single resource or by assigning responsibilities to existing team members. While a dedicated team can speed up maturity and drive wider adoption, starting with small, incremental steps is effective as your cloud usage grows.

Why is cross-team collaboration essential in FinOps?

Collaboration is essential because cloud costs affect every part of your organization. When finance, engineering, and operations share real-time cost data, they can collectively make informed decisions that balance innovation with efficient resource use.

What are the 3 pillars of FinOps?

The three pillars of FinOps are: Inform, Optimize and Operate

Is FinOps a tool?

No, FinOps isn’t a tool. It’s a framework and set of practices designed to manage cloud spend. That being said, various tools help implement FinOps processes by offering real-time cost data, automated alerts, and reporting.

How does FinOps adapt to multi-cloud environments?

FinOps adapts to multi-cloud setups by standardizing data formats and centralizing cost dashboards. This approach aggregates data from various providers, allowing you to apply consistent policies, compare costs across platforms, and use automation tools to manage spending uniformly.

What role does automation play in FinOps?

Automation is key to gathering real-time cost data, triggering alerts for anomalies, and adjusting resource allocation automatically. It minimizes manual effort, increases accuracy, and enables quick responses to changes in cloud spend.

How should organizations begin their FinOps journey?

Start by establishing clear, real-time cost visibility with standardized tagging and data collection. Pilot FinOps practices with a small team or a single project, then gradually expand responsibilities and processes as your cloud usage scales. This incremental approach helps integrate cost management into everyday operations while building a culture of accountability.

Is FinOps in demand?

Yes, FinOps is in demand. As companies scale their cloud usage, they need effective strategies to manage and optimize spending. This drives a growing need for professionals with FinOps expertise.

Is FinOps part of DevOps?

FinOps is related to DevOps in its emphasis on collaboration and continuous improvement, but it focuses specifically on managing cloud costs. They work hand-in-hand, yet FinOps remains distinct as the financial management aspect of cloud operations.